Contents:

Modeling contingent liabilities can be a tricky concept due to the level of subjectivity involved. The opinions of analysts are divided in relation to modeling contingent liabilities. Which of the following is the proper way to report a gain contingency? As an accrued amount.

A Beginner’s Guide to the Types of Liabilities on a Balance Sheet – The Motley Fool

A Beginner’s Guide to the Types of Liabilities on a Balance Sheet.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

For example, a firm may be _________ liable for damages under a lawsuit that has yet to be decided by the courts. Liability created when customers pay for goods or services in advance. Not be accrued unless a written contractual obligation exists. The obligation is attributable to employee services already performed. A liability is something a person or company owes, usually a sum of money.

In-person events

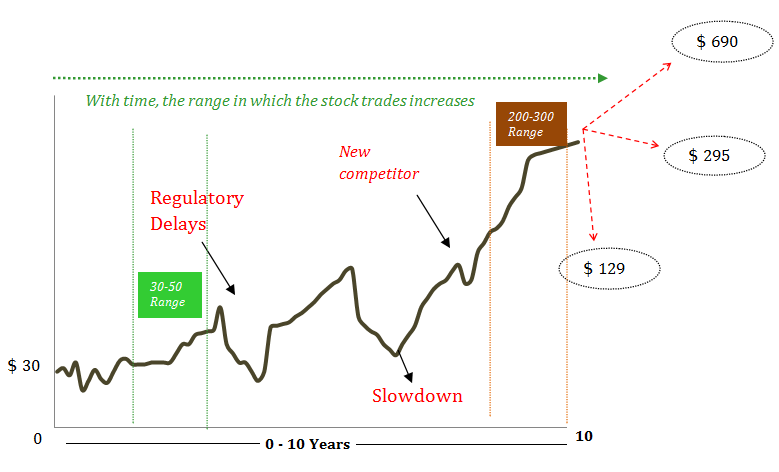

These liabilities can harm the company’s stock price because contingent liabilities can negatively impact the business’s future profitability. The magnitude of the impact depends on the time of occurrence and the amount tied to the liability. The accrual account permits the firm to instantly item an expense without the need for an immediate cash payment. Are the lawsuit results in ampere loss, a debit is applied to the gewachsen bill and liquid is credited by $2 million.

Identify a primary reason why financial statement users assess a company’s liquidity. Additional benefits such as health insurance, retirement benefits, or life insurance that are paid by the employer are called __benefits. Kenesha Co. reported income before interest expense and income taxes of $30,000; interest expense of $3,000; and income taxes of $4,000. Calculate the times interest earned ratio.

Disclosure of a contingent liability is usually made a. Parenthetically, in the body of the balance sheet. Parenthetically, in the body of the income statement. In a note to the financial statements.

IFRS and US GAAP have many subtle differences when accounting for provisions for legal claims. Let us see the example where a person has purchased a motorcycle from a showroom and has a two-year warranty for the engine and the motorcycle. If the engine fails to work within six months of the purchase, the company has to replace the engine. Hence, this is a contingent liability to the company.

NIKE, INC. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K) – Marketscreener.com

NIKE, INC. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K).

Posted: Thu, 21 Jul 2022 07:00:00 GMT [source]

Bond is convertible. Contractual interest rate is equal to the market interest rate. Welcome to Viewpoint, the new platform that replaces Inform. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. If some amount within the range of loss appears at the time to be a better estimate than any other amount within the range, that amount shall be accrued. When no amount within the range is a better estimate than any other amount, however, the minimum amount in the range should be accrued.

Contingent Assets Meaning

Read our latest news, features and press releases and see our calendar of https://1investing.in/s, meetings, conferences, webinars and workshops. All of the following statements about parenthood are true EXCEPT Group of answer choices A) couples who prepare for parenthood by attending classes or reading books are more satisfied with being a parent. B) stress is greater if parents are young and immature. C) women who receive social support during pregnancy experience more positive mental and physical health outcomes. D) research has found that parental support is not related to levels of depression in children. Give the adjusting entry that was made at the end of 2010 for depreciation on the manufacturing equipment.

A contingent liability is an existing situation that might result in a loss__ depending on the outcome of a future event. A__is a probable future sacrifice of economic benefits arising from present obligations to transfer assets or provide services as a result of past transactions or events. A business accounting journal is used to record all business transactions. Each business transaction is recorded using the double-entry accounting method, with a credit entry to one account and a debit entry to another.

- Identify a primary reason why financial statement users assess a company’s liquidity.

- Businesses are required to withhold taxes from employees’ earnings; standard withholdings include federal, state, and possibly city or county income taxes, as well as Social Security and Medicare.

- Contractual interest rate is equal to the market interest rate.

- Discount on Bonds Payable.

- Based on history, Boyd determines that warranty repairs are equal to approximately 2% of sales.

- Do not record or disclose a contingent liability if the probability of its occurrence is remote.

The accounting for warranty cost is based on the expense recognition principle, which requires that the estimated cost of honoring warranty contracts should be recognized as an expense a. When the product is brought in for repairs. In the period in which the product was sold. At the end of the warranty period. Only if the repairs are expected to be made within one year. A company receives $696, of which $56 is for sales tax.

What Is a Contingent Liability?

They are obligations that are very improbable to occur and do not need to be included in the financial statements at all. A possible contingency occurs when a liability may or may not occur, but the likelihood of its occurrence is less than 50% of that of a probable contingency. As a result, a potential contingency is usually mentioned in the footnotes rather than recorded in the books. For example, a company might face a contingent liability if it is involved in a lawsuit that has not yet been resolved.

A foreshadowing disclosure that precedes an accrual for a material contingent liability is typically expected. A loss contingency that is remote will not be recorded and it will not have to be disclosed in the notes to the financial statements. An example is a nuisance lawsuit where there is no similar case that was ever successful. Which of the following contingencies need not be disclosed in the financial statements or the notes thereto? Probable losses not reasonably estimable b.

IAS 37 has limited scope exclusions – e.g. rights and obligations under insurance contracts, income tax uncertainties, employee benefits, share-based payments. Remote – There is no need to record or reveal this contingent liability if the chances of its occurrence are remote. The accounting rules for the treatment of contingent liabilities are quite liberal; therefore, unless the risk involved is very high, there is no need to record them. When a company recognises the possibility of a loss in advance, it has the opportunity to make provisions for such losses, attempting to mitigate the impact of such future loss. However, this is not the reason for recording a contingency as a liability on the books.

State unemployment taxes. State income taxes. The future rates of pay expected to be paid when employees use compensated time. Total liabilities are the combined debts, both short- and long-term, that an individual or company owes. If the probability of occurrence is more than 50%. Monetary values are only reliable to a certain point as they are estimated and not an actual obligation.

Any post closing trial balance that have a probability of occurring over 50% are categorized under probable contingencies. These liabilities must be reflected in the company’s financial statements. Contingent liabilities are recorded to ensure that the financial commands are accurate and meet requirement of generally accepted accounting standards or International Financial Reporting Standards . Generally Accepted Accounting Principles has established rules and principles relating to contingent losses and contingent gains.

Although it is not realized in the books of accounts, a contingent liability is credited to the accrued liabilities account in the journal. The impact of contingent liability can also hamper a company’s ability to take debt from the market as creditors become more stringent before lending capital due to the uncertainty of the liability. If the liability arises, it would negatively impact the company’s ability to repay debt. Possible contingency is not recorded in the books of accounts because it is very difficult to articulate the liability in monetary terms due to its limited occurrence.

Federal and state taxes, and other withholdings totaled $350. Jorge’s net pay totals $_______. Jorge Lopez worked 40 hours this week and earned $1,000 in total compensation. Federal and state taxes and other withholdings totaled $350. Jorge’s gross pay totals $_______.

A contra account to Rent Revenue. A revenue account. Reported as a current liability.

The following sections discuss the disclosure considerations for loss and gain contingencies as provided by ASC 450. A provision for restructuring costs is recognised only when the entity has a constructive obligation because the main features of the detailed restructuring plan have been announced to those affected by it. What do we do once we’ve issued a Standard? We undertake various activities to support the consistent application of IFRS Standards, which includes implementation support for recently issued Standards.